- shows amount of Real GDP that the private, public, and foreign sector collectively desire to purchase at each possible price level

- relationship between price level and level of Real GDP is inverse

- Price Level ↑ Real GDP ↓

- Price Level ↓ Real GDP ↑

- Aggregate Demand Curve

3 Reasons AD is Downward Sloping -

- Real-Balance Effect

- when price level is high, households and businesses cannot afford to purchase as much output

- when the price level is low, households and businesses can afford to purchase more output

- Interest-Rate Effect

- higher price level increases interest rates which tends to discourage investment

- lower price levels decrease interest rate which tends to encourage investment

- Foreign Purchases Effect

- higher price level increases demand for relatively cheaper imports

- lower price level increases foreign demand for relatively cheaper U.S. exports

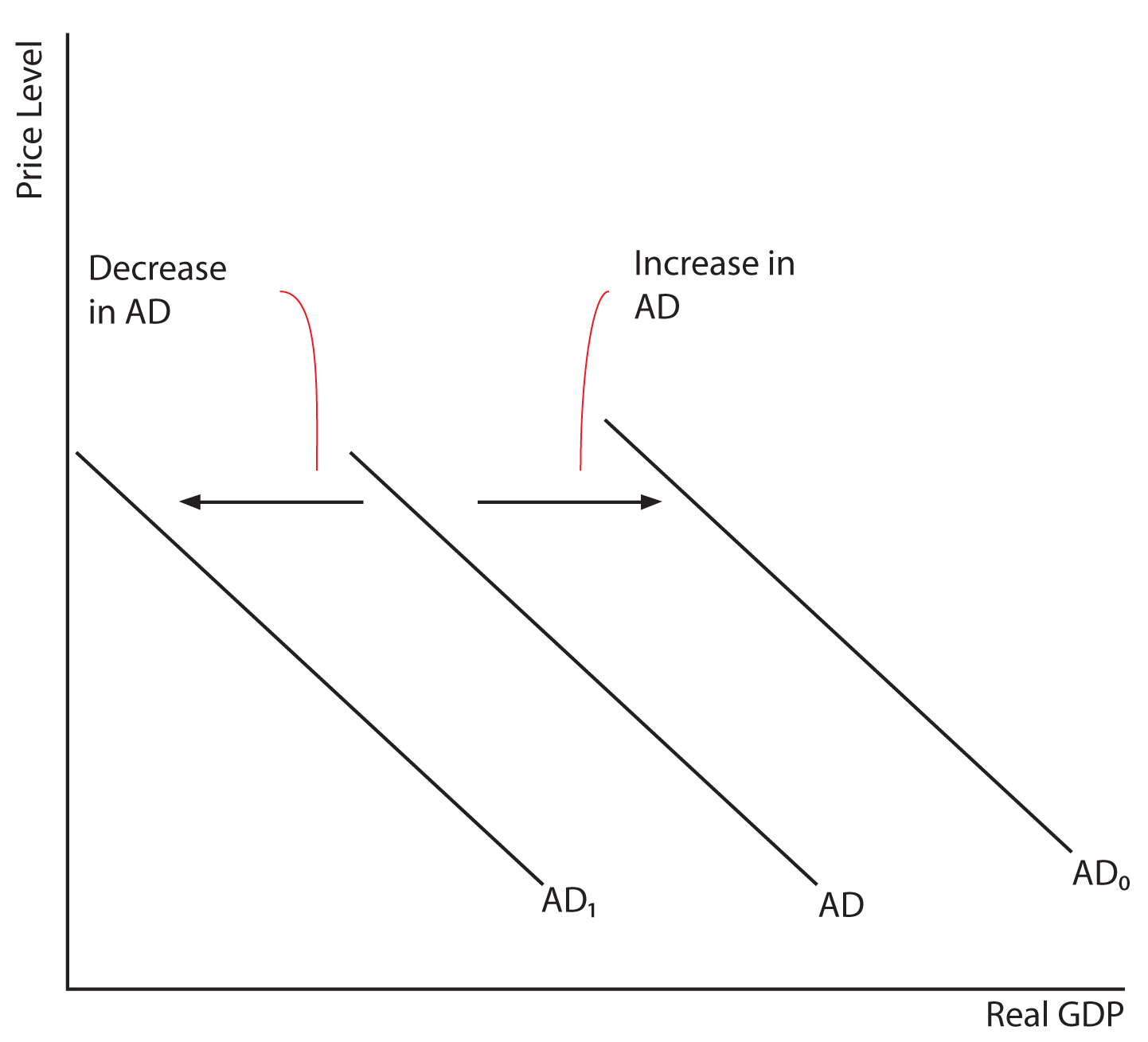

Shifts in AD -

- 2 parts to shift in AD

- changes in C, Ig, G, and/or Xn

- multiplier effect that produces greater change than original change in the four components

- increase in AD = AD →

- decrease in AD = AD ←

Shows the Decrease and Increase of AD

Consumption -

- Household spending is affect by :

- Consumer Wealth

- more wealth = more spending (AD →)

- less wealth = less spending (AD ←)

- Consumer Expectations

- positive expectations = more spending (AD →)

- ex : you know you will get a raise, so you go out and spend money the day before

- negative expectations = less spending (AD ←)

- Household Indebtedness

- less debt = more spending (AD →)

- more debt = less spending (AD ←)

- Taxes

- less taxes = more spending (AD →)

- more taxes = less spending (AD ←)

Gross Private Investment -

- Investment Spending is Sensitive to :

- Real Interest Rate

- lower real interest rate = more investment (AD →)

- higher real interest rate = less investment (AD ←)

- Expected Returns

- higher expected returns = more investment (AD →)

- lower expected returns = less investment (AD ←)

- expected returns are influenced by...

- expectations of future profitability

- technology

- degree of excess capacity (Existing Stock of Capital)

Government Spending -

- more government spending (AD →)

- less government spending (AD ←)

Net Exports -

- Net Exports are Sensitive to :

- Exchange Rates (international value of the dollar)

- strong dollar = more imports and fewer exports (AD →)

- weak dollar = less imports and more exports (AD →)

- Relative Income

- strong foreign economies = more exports (AD →)

- weak foreign economics = less exports (AD ←)

No comments:

Post a Comment