- Horizontal / Keynesian Range :

- there is a lot of unemployment resources or a constant price level as if in a recession

- Intermediate Range (SRAS) :

- resources are getting closer to Full Employment level, which creates an upward pressure on prices

- sticky wages can cause the AS curve to be positively sloped

- upward pressure on prices is caused by rising cost of doing business

- Vertical / Classical Range :

- real GDP is at a level with unemployment at Full Employment level, and where any increase in demand will result in increase of prices

- the unattainable region

Saturday, February 28, 2015

Aggregate Model (Traditional)

Fiscal Policy

- changes in expenditures or tax revenues of the federal government

Two Tools of Fiscal Policy (ONLY TWO OPTIONS)

- taxes - government can increase or decrease taxes

- spending - government can increase or decrease spending

Fiscal Policy was enacted to promote our nation's economic goals :

- Full Employment

- Price Stability

- Economic Growth

Deficits, Surpluses, and Debt

- Balanced Budget

- revenues = expenditures

- what you bring out, you bring in

- Balanced Deficit

- revenues < expenditures

- you bring out more than you bring in

- Balanced Surplus

- revenues > expenditures

- you bring in more than you bring out

- Government Debt

- sum of all deficits - sum of all surpluses

- government must borrow money when it runs a budget deficit

- government borrows from :

- individuals

- corporations

- taken from both of these by taxes

- financial institutions

- foreign entities or foreign governments

- taken from both of these by buying land or investing

Fiscal Policy Two Options

- Discretionary Fiscal Policy (action)

- Expansionary fiscal policy - think deficit (recession)

- Contractionary fiscal policy - think surplus (inflation)

- Non - Discretionary Fiscal Policy (no action)

- Allow what happens in the economy to fix itself

- Laissez - faire

- invisible hand

Discretionary v.s. Automatic Fiscal Policies

- Discretionary

- increasing or decreasing of government spending and or taxes in order to return economy to Full Employment

- discretionary policy involves policy makers doing fiscal policy in response to an economic problem

- Automatic

- unemployment compensation and marginal tax rates are examples of automatic policies that help mitigate the effects of recession and inflation

- automatic fiscal policy takes place without policy makers having to respond to the current economic problem

Contractionary v.s. Expansionary Fiscal Policy

- Contractionary Fiscal Policy -

- a policy designed to decrease AD

- strategy for controlling inflation

- decrease in government spending

- increase in taxes

- Expansionary Fiscal Policy -

- a policy designed to increase AD

- strategy for increasing GDP

- combating recession

- increase in government spending

- decrease in taxes

- reducing unemployment

Automatic / Built - In Stabilizers

- anything that increases government's budget deficit during a recession and increases its budget surplus during inflation without requiring explicit action by policy makers

- tax reduce spending and AD

- reduction in spending is desirable when the economy is moving towards inflation

- increase in spending is desirable when the economy is moving towards a recession

- President is not in charge of fiscal policy, Congressmen are

- Examples of Built - In Stabilizers :

- food stamps

- social securities

- welfare checks

- unemployment checks

- corporation dividends

- veteran's benefits

- (transfer payments)

- 33 - 50 % are taken out of economy

- When the economy goes down, the President steps in to fix the problem.

Progressive Tax System

- average tax rate (tax revenue / GDP) rises with GDP

Proportional Tax System

- average tax rate remains constant as GDP changes

Regressive Tax System

- average tax rate falls with GDP

Consumption and Savings

Disposable Income (DI)

- income after taxes or net income (spend or save)

- DI = Gross Income - Taxes

- 2 Choices :

- with disposable income, households can either -

- consume (spend money on goods and services)

- save (not spend money on goods and services)

Consumption

- household spending

- ability to consume is constrained by

- the amount of disposable income

- propensity to save

- the lower amount of money, more spending

- the higher the amount of money, more saving

- Do households consume if DI = 0 ?

- autonomous consumption

- dissavings

- APC = C / DI = % DI that is spent

Savings

- households NOT spending

- ability to save is constrained by

- the amount of disposable income

- propensity to consume

- Do households save if DI = 0 ?

- NO

- APS = S / DI = % DI that is not spent

APC and APS

- APC is the average propensity to consume

- APS is the average propensity to save

- APS is the average propensity to save

- APC + APS = 1

- 1 - APC = APS

- 1 - APS = APC

- APC > 1 .: Dissaving

- - APS .: Dissaving

MPC and MPS

- Marginal Propensity to Consume

- ∆ C / ∆ DI

- % of every extra dollar earned that is spent

- Marginal Propensity to Save

- ∆ S / ∆ DI

- % of every extra dollar earned that is saved

- MPC + MPS = 1

- 1 - MPC = MPS

- 1 - MPS = MPC

Speding Multiplier Effect

- initial change in spending (C, Ig, G, Xn) causes a larger change in aggregate spending or aggregate demand

- Multiplier = ∆ AD / ∆ in spending

- Multiplier = ∆ AD / ∆ C, Ig , G, Xn

- Why does this happen ?

- expenditures and income flow continuously, which sets off a spending increase in the economy

Calculating Spending Multiplier

- Multiplier = 1 / 1 - MPC or 1 / MPS

- multipliers are ( + ) when there is an increase in spending and ( - ) when there is a decrease

Calculating Tax Multiplier

- when the government taxes, the multiplier works in revers

- Why?

- because now the money is leaving the circular flow

- Tax Multiplier is always negative

- Multiplier = - MPC / 1 - MPC or - MPC / MPS

- if there is a tax cut, then the multiplier is ( + ), because there's now more money in the circular flow

Three Schools of Economics

Classical

- Jean B. Say

- Adam Smith

- David Ricardo

- Alfred Marshall

- competition is good for the economy

- "invisible hand"

- the market will take care of itself

- no extra intrusion in the market

- Say's Law

- supply creates its own demand

- AS is determined by the output

- economy is always close to or at Full Employment

- in the long run, economy will balance at Full Employment

- Trickle Down Effect

- it will help the rich first and then everyone else later

- Ronald Reagan believed in this

- Savings (or leakage) is an investment (or injection) due to the interest rate

- Savings (leakage) = Investment (injection)

- prices and wages are flexible downward (no involuntary unemployment)

- whatever output is produced will be demanded

- Laissez-faire (no government intervention)

Keynesian

- John Maynard Keynes

- "Competition is Flawed

- AD is the key, not AS

- savings (leaks) cause constant recessions

- Ratchet Effect and Sticky Wages block Say's Law"

- in the long run, we are all dead

- demand creates its own supply, therefore AD curve is unstable

- savers and investors save and invest for different reasons

- Saving ≠ Investment

- the economy is not always close to or at Full Employment

- prices and wages are inflexible downward

- inflexible downward = monopolistic competition

- there is government intervention

- fiscal or monetary policy

Monetary

- Allen Greenspan

- Ben Bernanka

- Congress cannot time policy options

- Government can best control health of economy by regulating banks and interest rates

- Easy or Tight Money

- Easy Money leads to recession

- Tight Money leads to inflation

- change the required reserves if needed

- use bonds through the open market operations

- use interest rates to change discount rates and federal fund rates

Thursday, February 26, 2015

Interest Rate and Investment Demand

- Investment = money spent / expenditures on :

- new plants (factories)

- capital equipment (machinery)

- technology (hardware or software)

- new homes

- inventories (goods sold by producers)

Expected Rates of Return

- How do business make investment decisions?

- Cost / Benefit Analysis

- How does business determine benefits?

- Expected rate of return

- How does business cont cost?

- Interest costs

- How does business determine the amount of investment they undertake?

- compare expected rate of return to interest cost

- if expected rate of return is more than interest cost, then invest

- if expected rate of return is less than interest cost, DO NOT invest

Real GDP (r %) versus Nominal GDP (i %)

- Difference between the two :

- Nominal GDP - observable rate of interest rate subtracted out of inflation ( %)and is only known as an ex post facto

- How to compute real interest rate (r %)?

- r % = i % - %

- What determines the cost of an investment decision?

- real interest rate (r %)

Investment Demand Curve (ID)

- What is the shape of the investment demand curve?

- downward sloping

- Why?

- when interest rates are high, fewer investments are profitable

- when interest rates are low, more investments are profitable

- ex :

Shifts in ID

- Cost of Production

- lower costs shift ID →

- higher costs shift ID ←

- Business Taxes

- lower business taxes (ID →)

- higher business taxes (ID ←)

- Technological Change

- new technology (ID →)

- lack of technology change (ID ←)

- Stock of Capital

- if an economy is low on capital, then ID →

- if an economy is much capital, then ID ←

- Expectations

- positive expectations (ID →)

- negative expectations (ID ←)

- Investment Demand shifts when different levels of Ig occur, even when r % is constant

Equilibrium of AS & AD

- determined by current output of real GDP

- Full Employment (FE)

- equilibrium exits when AD intersects SRAS and LRAS at the same point

- ex :

- LRAS curve (as shown above) represents a point on an economy's production possibility curve

- LRAS is ALWAYS vertical and is ALWAYS stable at Full Employment

- LRAS doesn't change as price level changes

- LRAS only shifts if there is :

- ∆ in resources

- ∆ in technology

- ∆ in economic growth

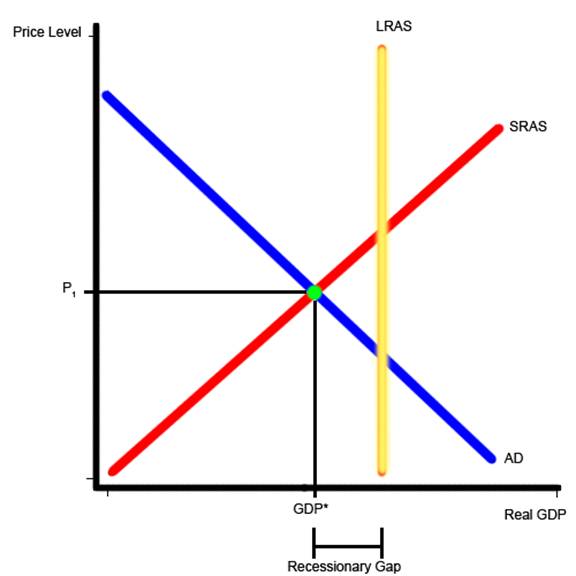

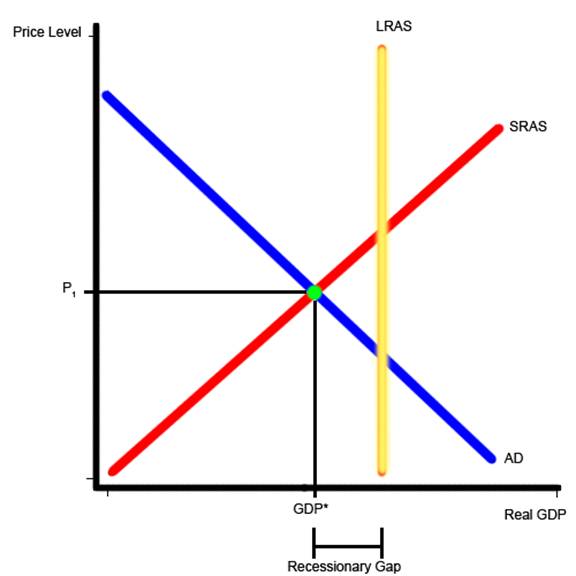

- Recessionary Gap

- exists when equilibrium occurs below full employment output

- ex :

- AS decreases at recessionary gap

- a gap that exists whenever equilibrium of real GDP per year is less than full employment real GDP as show by the position of SRAS (?)

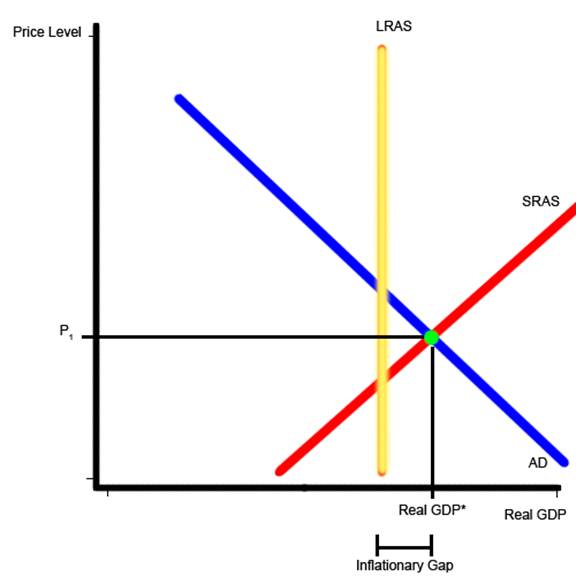

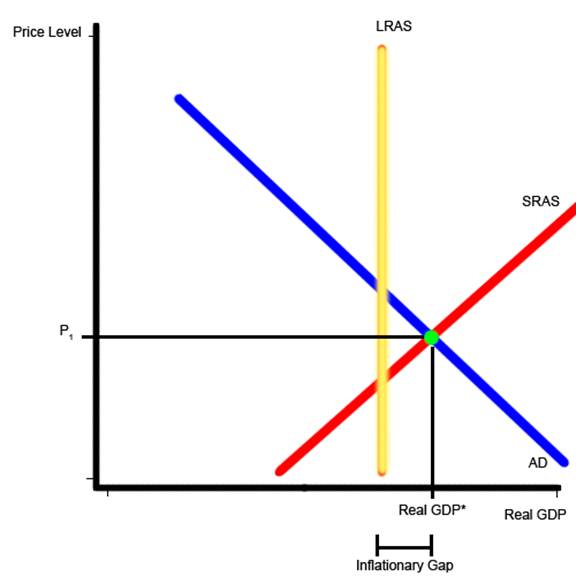

- Inflationary Gap

- exists when equilibrium occurs beyond full employment output

- ex :

- AD increases at inflationary gap

- C, Ig, G, and/or Xn - Expenditure Approach, Aggregate Demand, Real GDP = a type of output

Aggregate Supply (AS)

- level of real GDP (GDPR or output)that firms will produce at each price level (PL)

Long Run -

- period of time where input prices are completely flexible and adjust to changes in price level

- the level of GDPR supplied is independent of price level

Short Run -

- period of time where input prices are sticky and do not adjust to changes in the price level

- level of GDPR supplied is directly related to the price level

Long Run Aggregare Supply (LRAS) -

- LRAS marks the level of full employment (FE) in the economy (analogous to PPC)

- Because of the input prices are completely flexible in the long run, changes in the pricelevel do not change the firms' real profits and therefore do not change the firms' level of output

- this means that the LRAS is vertical at an economy's level of full employment (FE or YF)

Short Run Aggregate Supply (SRAS) -

- because input prices are sticky in SRAS, SRAS is upward sloping

Changes in the SRAS -

- increase in SRAS is seen as a shift to the right (SRAS )

- decrease in SRAS is ssseen as a shift to the left (SRAS )

- the key to understanding shifts in SRAS is per unit cost of production

- per-unit production cost = total input cost / total output

Shows the Decrease and Increase of SRAS

Determinants of SRAS (all affect unit production cost)

- Input Prices -

- Domestic Resource Prices

- wages (75% of all business costs)

- cost of capital

- raw materials (commodity prices)

- Foreign Resource Prices

- strong dollar = lower foreign resource prices

- weak dollar = higher foreign resource prices

- Market Power

- monopolies and cartels that control resources, control price of those resources

- increase in resource prices = SRAS ←

- decrease in resource prices = SRAS →

- Productivity -

- productivity = total output / total input

- more productivity = lower unit production cost (SRAS →)

- lower productivity = higher unit production cost (SRAS ←)

- Legal - Institutional Environment -

- Taxes and Subsidies -

- taxes (money that go to the government) on businesses, increase per unit production cost (SRAS ←)

- subsidies (money given from the government) to businesses, reduce per unit production cost (SRAS →)

- Government Regulation -

- government regulation creates a cost of compliance = SRAS ←

- deregulation reduces compliance costs = SRAS →

Wednesday, February 25, 2015

Aggregate Demand (AD)

- shows amount of Real GDP that the private, public, and foreign sector collectively desire to purchase at each possible price level

- relationship between price level and level of Real GDP is inverse

- Price Level ↑ Real GDP ↓

- Price Level ↓ Real GDP ↑

- Aggregate Demand Curve

3 Reasons AD is Downward Sloping -

- Real-Balance Effect

- when price level is high, households and businesses cannot afford to purchase as much output

- when the price level is low, households and businesses can afford to purchase more output

- Interest-Rate Effect

- higher price level increases interest rates which tends to discourage investment

- lower price levels decrease interest rate which tends to encourage investment

- Foreign Purchases Effect

- higher price level increases demand for relatively cheaper imports

- lower price level increases foreign demand for relatively cheaper U.S. exports

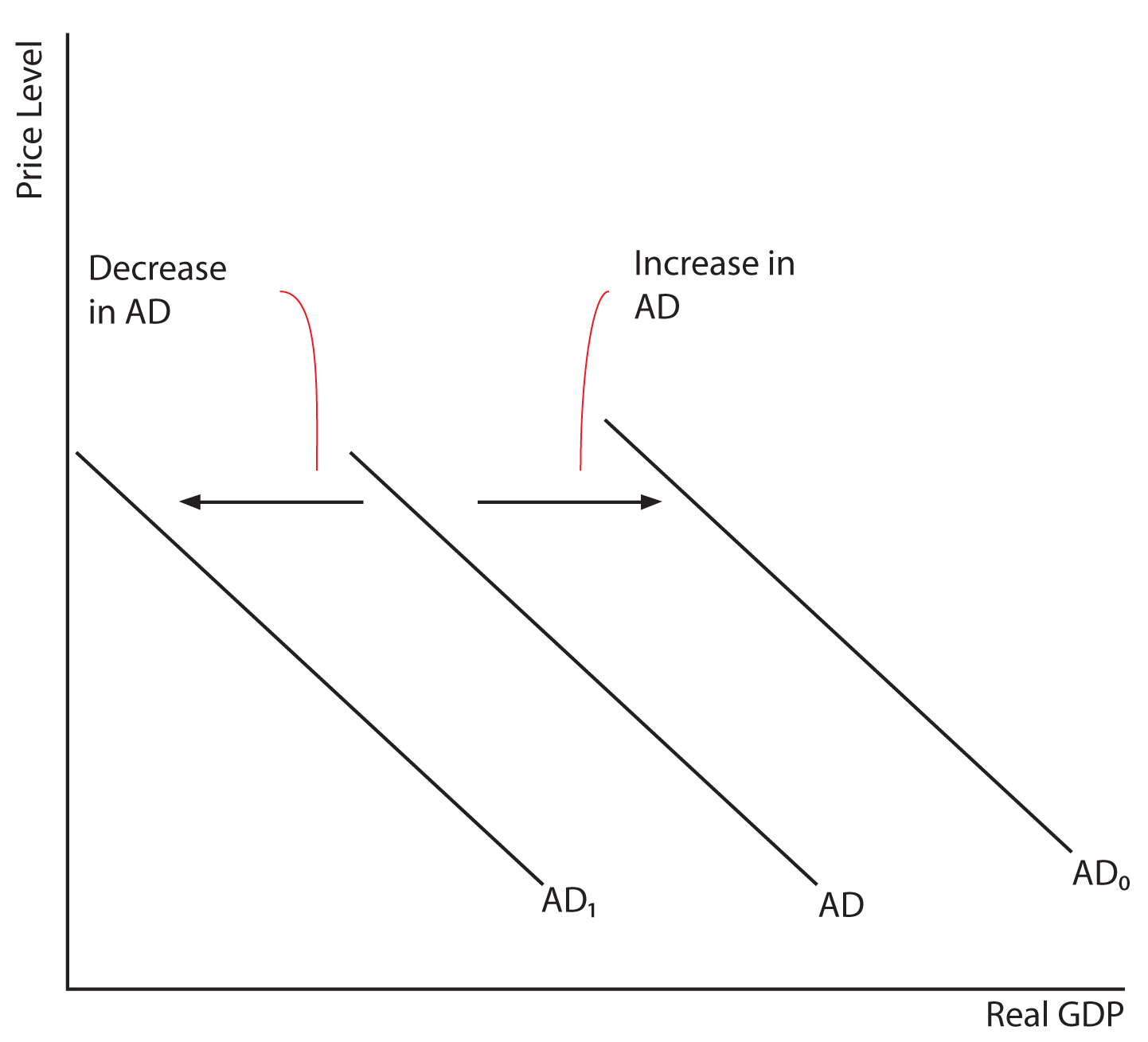

Shifts in AD -

- 2 parts to shift in AD

- changes in C, Ig, G, and/or Xn

- multiplier effect that produces greater change than original change in the four components

- increase in AD = AD →

- decrease in AD = AD ←

Shows the Decrease and Increase of AD

Consumption -

- Household spending is affect by :

- Consumer Wealth

- more wealth = more spending (AD →)

- less wealth = less spending (AD ←)

- Consumer Expectations

- positive expectations = more spending (AD →)

- ex : you know you will get a raise, so you go out and spend money the day before

- negative expectations = less spending (AD ←)

- Household Indebtedness

- less debt = more spending (AD →)

- more debt = less spending (AD ←)

- Taxes

- less taxes = more spending (AD →)

- more taxes = less spending (AD ←)

Gross Private Investment -

- Investment Spending is Sensitive to :

- Real Interest Rate

- lower real interest rate = more investment (AD →)

- higher real interest rate = less investment (AD ←)

- Expected Returns

- higher expected returns = more investment (AD →)

- lower expected returns = less investment (AD ←)

- expected returns are influenced by...

- expectations of future profitability

- technology

- degree of excess capacity (Existing Stock of Capital)

Government Spending -

- more government spending (AD →)

- less government spending (AD ←)

Net Exports -

- Net Exports are Sensitive to :

- Exchange Rates (international value of the dollar)

- strong dollar = more imports and fewer exports (AD →)

- weak dollar = less imports and more exports (AD →)

- Relative Income

- strong foreign economies = more exports (AD →)

- weak foreign economics = less exports (AD ←)

Friday, February 6, 2015

Unemployment

- Unemployment - percentage of people who do not have jobs but are in the labor force

- Labor force - number of people in a country that are classifed as either employed or unemployed

Not in the labor force :

- kids

- military personnel

- mentally insane

- prison

- retired

- stay at home parent

- discouraged worker

- someone who applies but cannot get a job, so they stop trying to look

- a hobo, beggar

Unemployment rate : 4 - 5% is ideal

- (# of unemployed) / (# of unemployed + # of employed) x 100

- or

- (# of unemployed) / (labor force) x 100

Types of Unemployment -

- Frictional :

- between jobs because of education level, lifestyles, opportunities and choices

- people that are between jobs may quit for a better job

- graduating and interviewing for job

- quit but actively looking for a job

- Seasonal :

- depends on what it is, working during certain times of the year

- ex : school bus drivers, construction workers

- Structural :

- associated with lack of skills or declining industry

- high school dropout and/or if you can't read or write

- technology changes

- Cyclical :

- associated with down turns in business cycle

- bad for society and individuals

- trough, depression

Both structural and cyclical unemployment is bad unemployment

What is Full Employment? - occurs when there is no cyclical unemployment present in the economy

- Natural Rate of Unemployment (NRU) : 4 - 5%

Why is Unemployment bad?

- not enough consumption (GDP)

- creates too much poverty

- creates too much government assistance

Why is it good?

- less pressure to raise wages

- more workers available for future expansions

Okun's Law - for every 1% of unemployment above the NRU, causes a 2% decline in real GDP

Official Employment Statistics -

- Start with total population of the U.S.

- subtract those under 16

- subtract those in the armed forces

- subtract those that are institutionalized

- This leaves the "Non Institutional Adult" population

- subtract those that are already retired

- subtract homemakers

- subtract full-time students over 16

- subtract the discouraged

- This leaves the "Civilian Labor Force"

- count employed full or part-time

- count employed unpaid workers in the family business

- count those on sick leave, on strike, or on vacation

- count unemployed, but are actively looking for work

- This becomes the "Unemployment Rate" in percentages (%)

- 0 - 3% : overextended economy, war economy

- 4 - 5% : "Full Employment" Unemployment Rate (Efficient)

- 6 +% : "Weak" Economy or "Recession" Economy

- 25 % : Highest official unemployment rate in 1933

Monday, February 2, 2015

Inflation

I. Inflation - rise in general price levels

II. Measuring Inflation

II. Measuring Inflation

- Inflation Rate - measures percentage increase of price level over time; a key indicator of economy's health

- deflation - decline in general price level (alternatives)

- disinflation - occurs when inflation rate itself declines (technology)

- Consumer Price Index (CPI) - measures inflation by tracking the yearly price of a fixed basket of goods and services

- indirect changes of cost of living and price level

III. Solving Inflation Problems

- Finding inflation rate using market basket data

- ((current year market basket data - base year market basket data) / base year market basket data) x 100

- Finding inflation rate using price indexes

- ((current year price index - base year price index) / base year price index) x 100

- Estimating inflation rate using the rule of 70

- used to calculate number of years it takes for price level to double at any given rate

- years needed to double inflation = 70 / annual inflation rate

- Determining real wages

- (nominal GDP / price level) x 100

- Finding real interest rate

- Real interest rate

- cost of borrowing or lending money adjusted for expected inflation

- nominal - inflation premium

- always a percentage (%)

- Nominal interest rate

- unadjusted cost of borrowing or lending money

IV. Causes of Inflation

- Demand - pull inflation : caused by excess of demand over output that pulls prices upward

- Cost - push inflation : caused by rise in per unit production cost due to increase of resource cost

V. Effects of Inflation

- Anticipated v.s. Unanticipated inflation

Hurt by Inflation -

- fixed income people

- lenders, creditors

- savers

Helped by Inflation -

- borrowers

Subscribe to:

Posts (Atom)